7 February 2026 12:00 AM

CT VETERANS Events

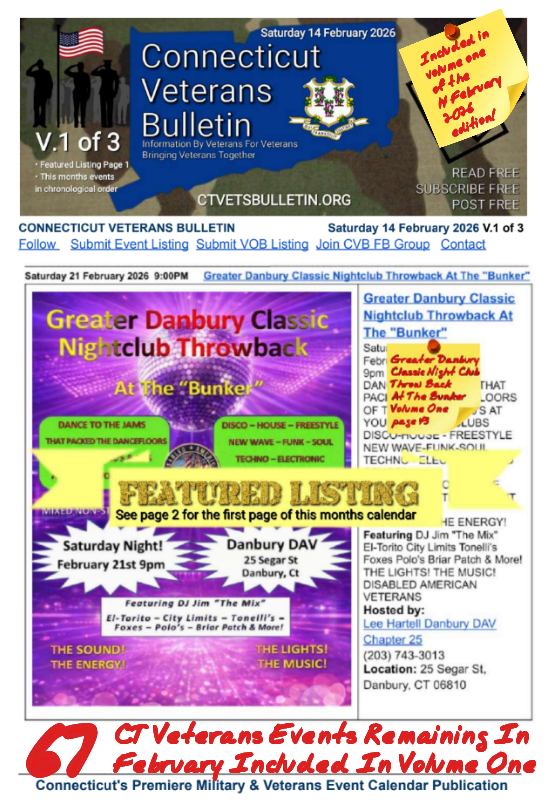

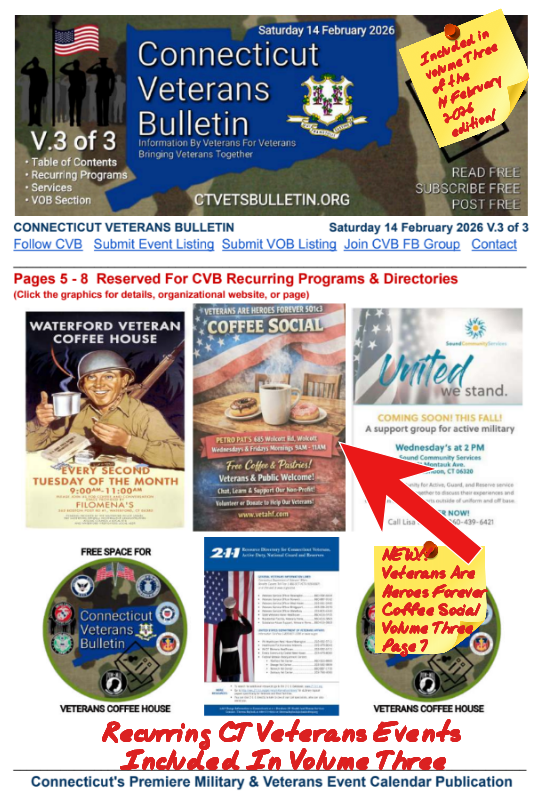

The 14 February 2026 Edition of CVB’s Weekly Connecticut Veterans Calendar Publication includes 67 events for CT Veterans remaining in February. Whereas Volume two Includes 83 events for CT Veterans beyond February. Volume three includes recurring CT Veterans events.

The Saturday 14 February 2026 edition of CVB’s Weekly Connecticut Veterans Calendar Publication brings together 67 verified veterans events remaining in February and 83 additional events extending from March through June 2026, all researched and compiled specifically for Connecticut’s military and veteran community. This edition features the Greater Danbury Classic Night Club Throw Back at The Bunker, the US Navy Band Sea Chanters in concert, and the Veterans Are Heroes Forever Coffee Social, alongside breakfasts, dinners, music, bingo, outreach programs, wellness initiatives, and support services hosted by American Legion posts, VFWs, DAV chapters, and veteran service organizations statewide. Published across three structured volumes, this issue ensures every listed event remains visible and accessible up to the day it occurs, reinforcing CVB’s role as Connecticut’s most comprehensive and continuously updated veterans events calendar.

V.1 Current months events

V.2 events beyond current month.

V.3 recurring programs & VOB Directory

Volumes 1-3, Access links & Table of Contents below👇

V.2 of 3

Click to access volume 2 CVB

Saturday 14 February 2026

V.3 of 3

Click to access volume 3 CVB

Saturday 14 February 2026

TABLE OF CONTENTS

Volume 1

Page 1 Featured Listing

Pages 2 – 67: CT Veterans Event Listings 14 February 2026 – 28 February 2026

Volume 2

Pages 1 -83: CT Veterans Event Listings 1 March 2026 – 20 June 2026

Page 84: Posting Guidance

Volume 3

Page 1 – 4 Table of Contents

Pages 5- 8: Recurring Programs & Directories, including CT Veterans Coffee Houses.

Pages 9 – 10: Donations Needed

Page 9: Care Package Drive

Page 10: EASTERSEALS VETERANS RALLY POINT LEGACY BRICKS BUY A BRICK, LEAVE A LEGACY!

Pages 11 – 25 Food & Dining

Page 11: Sunday Morning Breakfast @ Post 14’s Bistro Sunday Every Month 2022

Page 12: American Legion Auxiliary Unit 128 All You Can Eat Breakfast

Page 13: Wallingford VFW Post 591 Sunday Breakfast 1st Sunday Monthly

Page 14: VFW Post 1724 Breakfast 2nd Sunday monthly

Page 15: American Legion Post 113 Monthly Breakfast

Page 16: VFW Post 10688 Monthly Sunday Breakfast

Page 17: Easterseals Veterans Rally Point Food Pantry

Page 18: AMERICAN LEGION POST 68 BERLIN PASTA DINNER

Page 19: American Legion Post 68 Pasta Dinner

Page 20: VFW Post 399 Paradox Brewing Pizza & Brew Night

Page 21: VFW Post 10004 Canteen Menu

Page 22: American Legion Post 102 Spaghetti Dinner Night

Page 23: Duke’s Canteen Thursday and Friday Dinners

Page 24: All You Can Eat Steak Dinner @ Plainfield VFW

Page 25: Steak Night At The VFW

Pages 26 – 42 Fun

Page 26: American Legion Post 112 Music BINGO

Page 27: VFW Post 5095 Open Pool

Page 28: New London Ping Pong Club

Page 29: Nine Ball Pool Tournament

Page 30: Soldier Songs and Voices

Page 31: Veterans Coffee HOUSE

Page 32: American Legion Post 12 BINGO

Page 33: VFW Post 5095 Thursday Night BINGO

Page 34: American Legion Post 26 BINGO Night

Page 35: Front Line Fellowship Board Games Card Games & More

Page 36: American Legion Post 128 Karaoke

Page 37: Line Dancing At American Legion Litchfield

Page 38: American Legion Post 128 Friday Karaoke

Page 39: American Legion Dart Drop-In Tournament

Page 40: Moosup American Legion Post 91 Karaoke Night

Page 41: VFW 5095 East Hampton Karaoke

Page 42: American Legion Post 165 Family Bingo

Page 43: DAV Danbury Trivia Night

Page 44: American Legion Post 112 Karaoke Night

Page 45: Meetings

American Legion Post 117 Meetings

Page(s) 46 – 48: Membership Opportunities

Page 46: American Legion Riders Member Information Form/Application

Page 47: Surfside Veterans Meeting

Page 48: VAHF Monthly Membership – Sign up & Recruitment Meetings

Pages 49 – 67 Programs

Page 49: American Legion Post 12 Veteran of the Month Flag Ceremony

Page 50: Veterans Base Camp

Page 51: American Legion Online Courses

Page 52:: Heal Her Art

Page 53: Mission Role Call White Star Families Resources

Page 54: Easterseals Vets Peer to Peer Meetup Groups

Page 55: US Vet Connect Inc.’s- Veterans Outdoors Resource Hub

Page 56: Horse Feathers Veterans Program

Page 57: Veterans Equine Therapy

Page 58: Veterans Support Group

Page 59: WARRIORS FOR WARRIORS

Page 60: Shepherds Meadow Veterans

Page 61: VRP BROADCASTING STUDIO TRAINING & INTERNSHIP

Page 62: Dog Star Veterans Program

Page 63: Greater Windsor Veteran’s Council Veterans Outreach

Page 64: Weekly Veterans Program With Horses

Page 65: Art Group Therapy @Honor Wellness Center

Page 66: UCONN Entrepreneurship Boot Camp For Veterans

Page 67: CCSU Office of Veterans Affairs

Page 68: Connecticut Oral Health Initiative Salute to Smiles

Page 69 Publications

The Society of Forty Men and Eight Horses Voyageur Briefs

Pages 70 – 71 Services

Page 70: Connecticut Department of Labor Veterans Services

Page 71: Eastern CT Veterans Community Center

Page 72 Veteran Owned Business Section Has Moved to

Page 73: Message From The Editor

Page 74: Subscribe To CVB’S Weekly PDF For Email Delivery.

Page 75: Post Your Mil/Vet Related Event In CVB’S Weekly PDF publication.

Page 76: JOIN CVB GROUP ON Facebook/FOLLOW CVB’S MEMORIAL PAGE On Facebook

Page 77: Emergency Resources and Resources for Rent, Security, Utilities, Furniture and Apartment Listings As of 3 January 2023

CVB serves Connecticut’s military/veteran community by researching and promoting events and programs of interest from numerous resources in a weekly PDF publication and on social media platforms. Each event is listed in CVB’S Weekly PDF with a dedicated page and remains listed in all subsequent PDF issues, up to the Saturday before the event or the Saturday of the event.

Please inform your fellow Soldiers, Marines, Sailors and Airmen of Connecticut’s premier mil/vet events calendar.

#events2025,#veteran,#veteranactivities,#veteransupport,#veteranowned,#connecticut,#connecticutveteransbulletin,#ctvets,#ctveteransbulletin,#ct,#ctvetsbulletin.org

Leave a comment