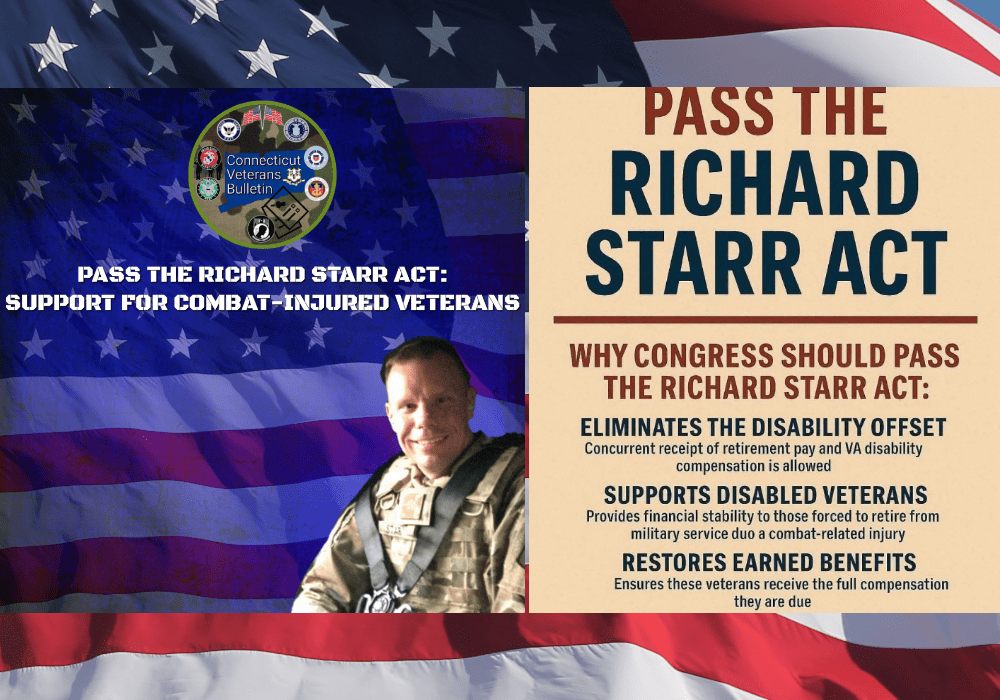

PASS THE RICHARD STARR ACT: SUPPORT FOR COMBAT-INJURED VETERANS

The Richard Starr Act remains one of the most important pieces of legislation currently before Congress for America’s combat-injured veterans. Named after Major Richard A. Starr, a decorated Green Beret who was forced into medical retirement after sustaining severe combat injuries in Afghanistan, the act seeks to correct long-standing inequities that affect thousands of disabled veterans across the country.

The Issue: The Disability Offset

Under current law, many veterans who are medically retired with less than 20 years of service face a reduction in their retirement pay equal to the amount of their VA disability compensation. This is known as the disability offset, and it prevents these veterans from receiving the full retirement benefits they earned along with their VA compensation. Veterans with 20 or more years of service, or those whose disabilities are rated as combat-related under specific programs, may receive both—a policy known as concurrent receipt. However, the gap leaves many combat-injured veterans unfairly excluded.

The Richard Starr Act would eliminate this offset for combat-injured veterans who were forced to medically retire before completing 20 years of service. In effect, it ensures these veterans receive both their retirement pay and disability compensation without penalty.

What the Act Would Do

- Eliminate the Disability Offset: Veterans would no longer have retirement pay reduced by the amount of their VA disability compensation.

- Restore Earned Benefits: Ensures that medically retired combat-injured veterans receive both retirement pay and VA disability compensation, as they were intended.

- Provide Financial Stability: Many veterans injured in combat are forced into early retirement, ending their careers prematurely. This legislation helps restore financial stability for their families.

Support and Opposition

The Richard Starr Act has strong bipartisan support. In the House, it has been introduced by Representative Gus Bilirakis (R-FL) and Representative Raul Ruiz (D-CA), and in the Senate by Senator Jon Tester (D-MT) and Senator Mike Crapo (R-ID). Veterans service organizations (VSOs) including the Disabled American Veterans (DAV), Military Officers Association of America (MOAA), and the Wounded Warrior Project have endorsed the bill, emphasizing that no veteran should lose earned retirement benefits due to combat injuries.

Opposition to the bill has not centered on its intent, but rather on its cost. The Congressional Budget Office (CBO) has estimated that expanding concurrent receipt under the Richard Starr Act would cost several billion dollars over a decade. Some lawmakers have expressed concern over the fiscal impact. However, VSOs argue that the cost reflects promises made to servicemembers who were medically retired due to combat wounds, and that these benefits were already earned.

The Broader Context

This legislation is part of a larger, long-standing debate over concurrent receipt. Since 2004, Congress has taken steps to allow some retirees with disabilities to receive both retirement pay and disability compensation, but gaps remain. The Richard Starr Act specifically addresses the group of combat-injured veterans forced to retire before reaching 20 years of service.

Without the act, thousands of veterans—many of whom sustained severe, life-changing injuries in Iraq and Afghanistan—continue to see reduced retirement pay simply because their military careers were cut short by combat wounds.

Conclusion

The Richard Starr Act is not about creating new entitlements; it is about restoring earned benefits to those who sacrificed their health and careers in combat service. Veterans organizations, bipartisan lawmakers, and military families are urging Congress to pass this legislation without further delay.

For more information and updates:

- Congress.gov: Richard Starr Act (H.R.1282) – https://www.congress.gov/bill/118th-congress/house-bill/1282

- Military Officers Association of America (MOAA) – Richard Starr Act Advocacy – https://www.moaa.org/content/publications-and-media/news-articles/2023-news-articles/advocacy/moaa-strongly-supports-richard-starr-act/

- Disabled American Veterans (DAV) – Support for the Richard Starr Act – https://www.dav.org/learn-more/news/2023/dav-urges-congress-to-pass-richard-starr-act/

- Wounded Warrior Project Statement on Richard Starr Act – https://newsroom.woundedwarriorproject.org/2023-02-28-Wounded-Warrior-Project-Supports-the-Richard-Starr-Act

- Congressional Budget Office (CBO) Cost Estimate – https://www.cbo.gov/system/files/2023-07/hr1282.pdf

CVB Fact Sheet: Major Richard Star Act (S.1032 / H.R.2102)

What the bill does

Corrects the “disability offset” for medically retired (Chapter 61) servicemembers whose disabilities are combat-related, allowing concurrent receipt of DoD disability retired pay and VA disability compensation (no dollar-for-dollar offset under 38 U.S.C. §§5304–5305). It amends 10 U.S.C. §§1413a & 1414 to create this narrow exception.

Source & text: https://www.congress.gov/bill/119th-congress/senate-bill/1032/text

Who is affected

- Disability retirees with fewer than 20 years of service (Chapter 61) whose conditions meet the statutory “combat-related” criteria (e.g., armed conflict, hazardous service, instrumentality of war, or simulated war).

- It does not apply to all retirees or to non-combat-related disabilities.

CRSC/“combat-related” definition: https://www.law.cornell.edu/uscode/text/10/1413a ; DFAS CRSC overview: https://www.dfas.mil/RetiredMilitary/disability/crsc/

Why there’s an offset today

Federal law bars duplicate payments and requires a waiver of retired pay to receive VA compensation (38 U.S.C. §§5304–5305). Some retirees get partial relief via CRDP or CRSC, but Chapter 61 retirees with <20 years generally do not qualify for CRDP, leaving a gap the bill addresses.

Statutes & DFAS explainer:

- 38 U.S.C. §5304: https://www.law.cornell.edu/uscode/text/38/5304

- 38 U.S.C. §5305: https://www.govinfo.gov/link/uscode/38/5305

- DFAS CRDP/CRSC page: https://www.dfas.mil/RetiredMilitary/disability/VA-Waiver-and-Retired-Pay-CRDP-CRSC/

Current status (as of September 4, 2025)

- S.1032 (Senate): Introduced Mar 13, 2025 by Sen. Richard Blumenthal (CT); 76 bipartisan cosponsors; referred to Senate Armed Services.

https://www.congress.gov/bill/119th-congress/senate-bill/1032 ; https://www.congress.gov/bill/119th-congress/senate-bill/1032/cosponsors - H.R.2102 (House): Introduced Mar 14, 2025; 301 cosponsors; referred to House Armed Services and VA (Subcommittee on Disability Assistance and Memorial Affairs on Apr 4, 2025).

CT cosponsors include Reps. Courtney, DeLauro, Hayes, Himes, Larson.

https://www.congress.gov/bill/119th-congress/house-bill/2102 ; https://www.congress.gov/bill/119th-congress/house-bill/2102/cosponsors

Effective date if enacted

Applies the first day of the first month after enactment; no retroactive payments are specified in S.1032.

Text: https://www.congress.gov/bill/119th-congress/senate-bill/1032/text

Fiscal impact (best official estimate available)

CBO’s estimate for the substantially similar 118th-Congress bill (H.R.1282) projected $9.75B in increased direct spending (2024–2033) and $7.15B in spending subject to appropriation (accruals). Claims of “$30B+” are unsupported by CBO.

CBO/Committee report:

- https://www.cbo.gov/publication/59244

- https://www.congress.gov/committee-report/118th-congress/house-report/149/1

Other views (beyond veterans’ groups)

- Supporters (MOAA, DAV, VFW, WWP, BVA) argue the bill restores earned service-based retired pay and corrects an inequity unique to combat-injured medical retirees.

- Skeptics focus on cost and precedent (extending concurrent receipt beyond current law). The official cost discussion is captured in the CBO estimate and House report’s budget sections.

How concurrent receipt works today (baseline)

- CRDP: Generally for 20+-year retirees with VA rating 50%+; phased-in previously, now fully in effect.

- CRSC: Tax-free, for combat-related disabilities; for Chapter 61 with <20 years, CRSC plus any remaining retired pay cannot exceed the longevity-based retired pay — which is why many still see a net offset.

DFAS explainers:

https://www.dfas.mil/RetiredMilitary/disability/crdp/ ; https://www.dfas.mil/RetiredMilitary/disability/crsc/

Bottom line

The Major Richard Star Act would end the offset for combat-injured, medically retired servicemembers (<20 years), allowing concurrent DoD retired pay + VA compensation going forward if enacted. As of Sept 4, 2025, it has not been enacted. Costs are materially below some public claims, per CBO.

Sources

- S.1032 (text, status, cosponsors): https://www.congress.gov/bill/119th-congress/senate-bill/1032

- H.R.2102 (status, cosponsors): https://www.congress.gov/bill/119th-congress/house-bill/2102

- 118th House Report w/ CBO detail: https://www.congress.gov/committee-report/118th-congress/house-report/149/1

- CBO estimate (H.R.1282): https://www.cbo.gov/publication/59244

- DFAS CRDP: https://www.dfas.mil/RetiredMilitary/disability/crdp/

- DFAS CRSC: https://www.dfas.mil/RetiredMilitary/disability/crsc/

- DFAS VA Waiver & CRDP/CRSC overview: https://www.dfas.mil/RetiredMilitary/disability/VA-Waiver-and-Retired-Pay-CRDP-CRSC/

- 38 U.S.C. §5304: https://www.law.cornell.edu/uscode/text/38/5304

- 38 U.S.C. §5305: https://www.govinfo.gov/link/uscode/38/5305

- CRS “Concurrent Receipt” primer: https://www.congress.gov/crs-product/IF10594

- MOAA on Star Act: https://moaa.org/content/take-action/legislative-action-center/major-richard-star-act/

- BVA (Blinded Veterans Association) update: https://bva.org/major-richard-star-act-remains-high-priority-on-bva-legislative-radar/

Discover more from CONNECTICUT VETERANS BULLETIN

Subscribe to get the latest posts sent to your email.